An organizational model that brings out value

An organizational model that brings out value

Our organization is evolving by developing a new corporate and operating model based on four business lines.

Industrial

Industrial

Efficient industrial transformation: green hydrogen, circular CO2, and sustainable economy.

Customer

Customer

Digital and multi-energy solutions, customized for home and mobility, which adapt to your needs.

Low-emissions generation

Low-emissions generation

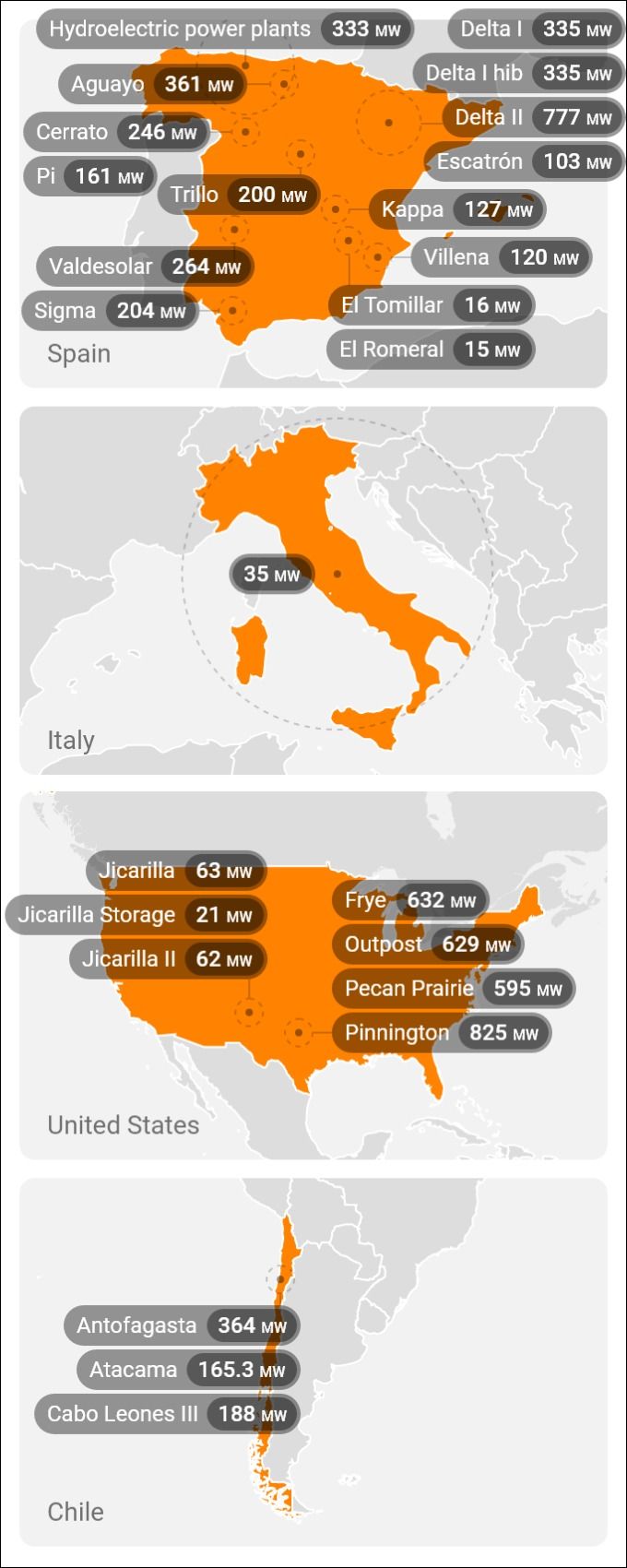

Portfolio growth and further international expansion with a target of 9-10 GW by 2027 and 15-20 by 2030.