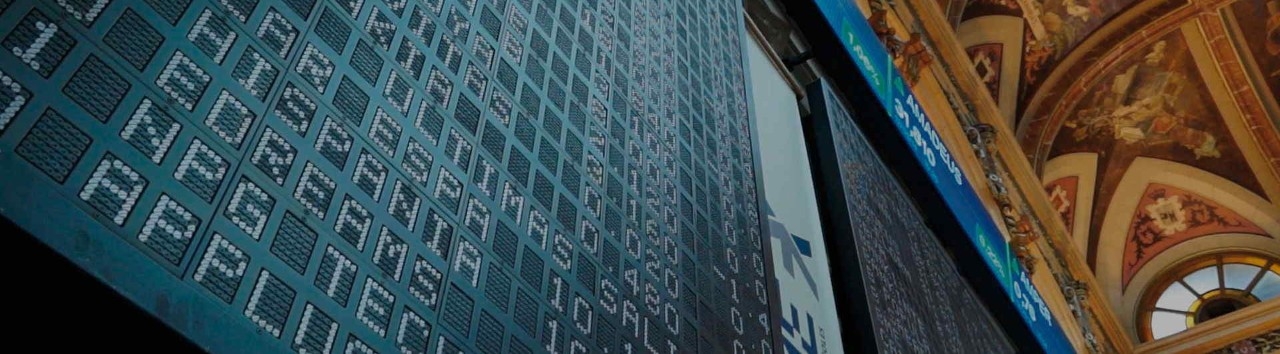

Repsol on the stock exchange

Monitor your share prices

Find out all the information about Repsol on the Stock exchange, shareholder remuneration, and everything concerning our presence on the stock market. Check the price trend and compare it with other industry benchmarks.

Repsol on the stock exchange

Repsol on the stock exchange