Risk management

We face and anticipate risks

Somos una compañía energética global e integrada, y como tal nos encontramos expuestos a riesgos de diferente naturaleza que pueden afectar nuestro desempeño futuro y que debemos mitigar de la forma más efectiva posible.

We are a global, integrated energy company, and as such, we are exposed to risks of various nature that may affect our future performance and that we must mitigate in the most effective way possible.

Main risks

We have an organization, procedures, and systems that allow us to reasonably manage the risks to which we are exposed. These risks are an integral part of the Group's decision-making processes, both within the corporate governance bodies and in business management. The Group's main risks are identified below based on their importance in terms of finances, reputation, and people taking into consideration a five-year time frame:

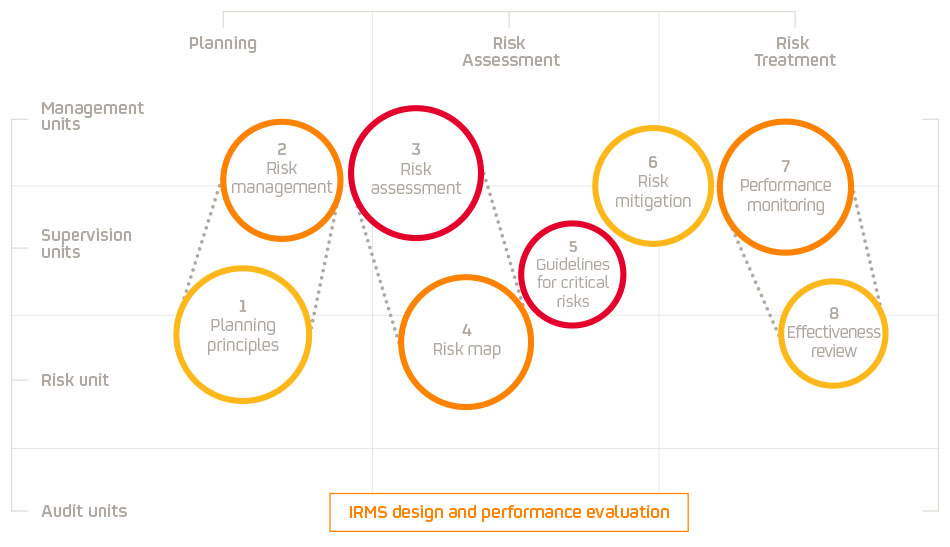

Integrated Risk Management System (IRMS)

For years now, we have been working on an integrated risk management system designed to comprehensively identify, analyze, and control risks. The Integrated Risk Management System (IRMS) provides a comprehensive and reliable view of all risks that might affect the company, regardless of their nature.

The IRMS is based on the Risk Management Policy approved by the Board of Directors, and its principles are specified in the Integrated Risk Management Standard. This management model is based on the international reference standard ISO 31000 and the Three Lines of Defense Model.

The fundamental pillars of the IRMS are:

- Leadership of integrated risk management by senior management, providing the necessary resources, and ensuring that the organization works in accordance with these principles

- Integration in all management processes, always with the global approach provided by the Risk Policy Division

- Differentiated responsibility of the units and bodies involved, based on the "Three Lines of Defense" model.

- Global and harmonized management, which ensures that all risks are managed according to the same identification, assessment, and resolution process defined in the ISO 31000 standard

- Continuous improvement through periodic reviews of the management framework.

Repsol maintains low-to-medium risk profile that is appropriate for a global and integrated energy company that is present throughout the entire value chain by undertaking its activities in a diversified way. This commitment combines quantitative and qualitative elements in criteria an principles of action inherent to its strategy, culture, and values.

The IRMS is not just seen by senior management as a tool to define the company strategy as it is also meant to improve operations and help take on critical situations with flexibility while fortifying the Company.

Main risks

Main risks

The Repsol Group's main identified risks are described below:

- Fluctuations in the benchmark prices of hydrocarbons and derivative products

Crude oil prices are subject to exogenous factors and therefore to volatility, as a consequence of fluctuations in international supply and demand, impacted by the geopolitical environment, OPEC influence, technological changes or natural disasters. On average, the price of Brent crude stood at $71.3/bbl in 2018, up 32% on the average for 2017 ($54.2/bbl). On average, the price of HH gas stood at $3.1/Mbtu in 2018, in line with those of 2017.

The reduction in crude oil prices adversely affects the profitability of Upstream activity, the valuation of its assets, its capacity to generate cash and its investment plans. A significant drop in capital investment could negatively affect Repsol's ability to replace its crude oil reserves.

In turn, international product prices, influenced by the price of crude oil, can impact the margins of the Downstream Refining and Commercial businesses. High product prices can also affect demand for them..

- Competitive depositioning:

The activity of the energy industry takes place in the context of a highly competitive sector. Such competition may be intensified by a number of factors including the entry of new competitors, changes in market conditions, the expiration of administrative concessions, technological obsolescence or insufficient differentiation The combined effect of these factors may affect business volumes and margins.

- Administrative, judicial and arbitration proceedings

The Repsol Group is subject to the effects of administrative, judicial and arbitration proceedings arising in the ordinary course of business whose scope, content and outcome cannot be predicted with precision. For further information on some of these proceedings, see Note 14.2 of the Consolidated Financial Statements.

- Regulatory risks

The energy industry and the Group’s activity is heavily regulated. The current regulatory framework affects aspects such as the environment, competition, taxation, industrial safety and IT security, among others. Any changes that may be made to the applicable standards or any deviations in their strict observance, or their interpretation, may adversely affect the business, results and financial position of the Repsol Group.

In particular, the regulatory areas that generate this exposure of the Group include tax regulation and interpretation, the wide variety of environmental and safety legislation (environmental quality standards for products, air emissions and climate change, energy efficiency, extractive technologies, water discharges, remediation of soil and groundwater and the generation, storage, transport, treatment and final disposal of waste materials), accounting and transparency regulations and regulations governing data protection.

Repsol also reports on estimated proven and unproven reserves of oil and gas, which present an uncertainty that is inherent to the the assessment process, which is subject to judgements and estimations (see note 3 of the Consolidated Financial Statements).

In addition, Repsol may be affected by the existence of sanctions and trade embargo regimes adopted by the EU, its Member States, the US or other countries, as well as supranational bodies such as the United Nations, on certain countries and/or companies or individuals based in them.

- Arbitrary actions and loss of assets due to government decisions

Part of Repsol's activities are carried out in countries that present or may present scenarios of social, political or economic instability that could lead to situations such as the increase of taxes and royalties, the establishment of production limits and volumes for exports, mandatory renegotiations or annulment of contracts, regulation of product prices, nationalization, expropriation or confiscation of assets, loss of concessions, changes in government policies, changes in commercial customs and practices or delayed payments, among others.

Specifically, Repsol operates in countries with special geopolitical risk such as Venezuela, Libya, Algeria, or in regions in territorial dispute between states such as the South China Sea (Vietnam). For further information, see Note 20.3 of the Group’s consolidated financial statements.

- Accident rate

Repsol's industrial and commercial assets (refineries, petrochemical complexes, regasification plants, power generation plants, bases and warehouses, port facilities, pipelines, ships, tanker trucks, service stations, etc.) as well as E&P's own facilities (exploratory or production wells, surface facilities, oil platforms, etc.), both onshore and offshore, are exposed to accidents such as fires, explosions, toxic product leaks and environmental incidents with a large potential impact. Such accidents may cause death and injury to employees, contractors, residents in surrounding areas, as well as damage to the assets and property owned by Repsol as well as third parties.

The Repsol Group is exposed to impacts from any type of damage or temporary interruption of service associated with accidents in operations or involving land, sea, river, and air transport vehicles for people or substances.

- Deviations in the execution of investment projects

Repsol executes investment projects of various types, both in physical and IT assets. The Group's Downstream and and Upstream projects are in many cases complex due to their nature and/or size and are exposed to execution delays and deviations from the initially budgeted costs. The projects to dismantle offshore platforms in Norway and the United Kingdom stand out for their complexity and environment.

Part of the projects of the Repsol Group are carried out though joint ventures associated in which the Group's capacity to control and influence the functioning and management of operations, and to identify and manage related risks, is limited.

- Deviations in organizational management and of employees in ethics and conduct

The Repsol Group is exposed to negative impacts arising from the management of the organization and its employees, which constitute a key asset for the Group and which, in certain business contexts, may prove inadequate for achieving its objectives. The factors triggering such impacts include aspects such as talent attraction and retention, organizational structure, both in terms of design and dimensioning, and labor relations.

- Errors and failures in production and/or transport processes:

The Repsol Group is exposed to potential impacts related to failures or deviations from planned results in the operation and/or maintenance of industrial complexes (refineries, petrochemical complexes, regasification plants and so on) or logistics facilities for transporting raw materials or products (gas pipelines, oil pipelines and polyducts), as well as in reserve operation activities, among others.

- Attacks against people or assets

In general, but especially in certain countries where it operates, Repsol is exposed to potential impacts deriving from acts of direct violence that may endanger the integrity of both the Company's assets, whether physical or logical, and of the persons linked to it as a result of the actions of persons or groups motivated by any interests, whether governmental or not, including, among others, acts of terrorism, delinquency, and piracy.

Noteworthy are the special safety conditions in Libya, where there have been intermittent stoppages of hydrocarbon production in 2018. See Note 20.3 of the 2018 consolidated financial statements.

Related documents