Repsol posts net income of 2.121 billion euros, the highest in six years

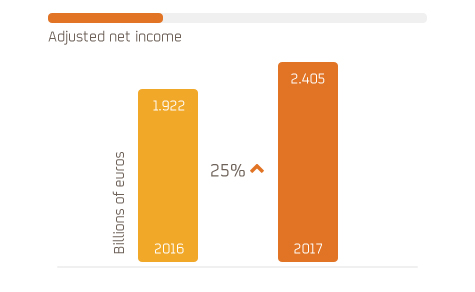

- Net income increased by 22% and the adjusted net income, which measures the performance of business’s, increased by 25% to 2.405 billion euros. Both incomes are the highest in the last six years.

- EBITDA stood at 6.723 billion euros, a 29% improvement on the previous year and the highest in five years.

- The 2017 earnings reflected the strength of the company’s integrated model, its flexibility and its capacity to adapt to lower crude oil and gas prices.

- The Upstream business (Exploration and Production) saw a twelvefold profit increase to 632 million euros, with an increase in production to 695,000 barrels of oil equivalent per day added to significant hydrocarbon discoveries.

- The Downstream (Refining, Chemicals, Marketing, Lubricants, Trading, LPG, Gas & Power) earnings totaled 1.877 billion euros, with growth in Refining, Marketing and Trading and Gas & Power and Peru. The refining margin indicator in Spain grew by 7.9% to 6.8 dollars per barrel.

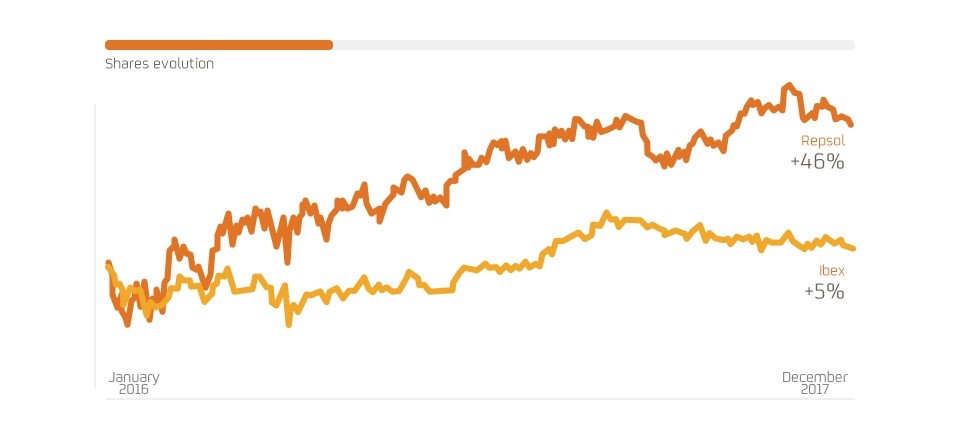

- Repsol’s shares appreciated 10% over the financial year, for a 46% stock increase in the last two years.

- The company was the first in its sector worldwide to issue a certified green bond to finance more than 300 sustainable initiatives.

Repsol posted net income of 2.121 billion euros in 2017, 22% more than the 1.736 billion it earned in 2016. In a low price scenario for raw materials, the company, supported by the strength of its business and its efficiency plans, achieved the highest net income in six years.

Repsol’s integrated business model allowed the company to successfully navigate the environment and exploit the slight recovery of crude oil and gas prices beginning in June. Management focused on value creation, flexibility and diversification provided by business integration to boost the adjusted net income, which grew by 25% to 2.405 billion euros, compared to 1.922 billion in 2016.

The Upstream unit earned a profit of 632 million euros, 12 times that obtained the previous year. This significant improvement was the result of measures adopted in its synergies and efficiency plan, the resumption of activity in Libya and rising international benchmark prices.

As for Downstream, its profit of 1.877 billion euros was in line with that of previous years, marking this business division as a major generator of cash for the company. Throughout the year, the Refining, Peru, Marketing and Trading and Gas & Power areas increased their results, Lubricants increased sales and Chemicals maintained the robustness of the past two years.

The strong behavior of Repsol businesses resulted in a 29% increase in EBITDA, to 6.723 billion euros, the best result of the last five years.

At the same time, the company reduced its debt by 23% to 6.267 billion euros at the end of the year.

The implementation of the synergies and efficiency program generated approximately 2.4 billion euros in savings, exceeding expectations and meeting its objective of 2.1 billion euros, set forth in the strategic plan, one year earlier than anticipated.

The company’s performance and the fulfillment and exceedance of the goals announced to the market had a direct impact on evaluations from rating agencies, which unanimously increased their ratings.

All of this data was reflected in the stock market, where Repsol shares saw an annual appreciation of 10%, for a total of 46% over the last two years.

In May, Repsol issued a certified green bond and became the world’s first company in its sector to use this type of asset, which will finance more than 300 initiatives aimed at improving energy efficiency and reducing CO2 emissions.

On February 22nd, 2018, Repsol reached an agreement with Rioja Bidco Shareholdings, SLU, a company controlled by CVC-advised funds, for the sale of its 20.072% share in Gas Natural, for a total of 3,816,314,502 euros: equivalent to 19 euros per share. The capital gains obtained by Repsol would amount to approximately 400 million euros.

Upstream: increased earnings, more production and significant discoveries

The adjusted net income of the Upstream unit reached 632 million euros, for an increase of 580 million euros compared to the 52 million euros registered in 2016.

The measures implemented by the company through its synergies and efficiency program allowed it to take advantage of the slight recovery in raw material benchmark prices, which added to the resumption of activity on Libya to improve the financial results of this business area.

The average price of raw material benchmarks remained low in 2017: Brent was 54.2 dollars per barrel and Henry Hub stood at 3.1 dollars per Mbtu. In the second half of the year the market reflected an upward trend in prices, and Brent closed the financial year above 66 dollars per barrel, its highest price since June 2015.

The company increased its production to reach an average of 695,000 barrels of oil equivalent per day thanks to the resumption of activity in Libya, increases obtained in various assets and the launch of new projects, such as Juniper (Trinidad and Tobago); Lapa and Sapinhoa (Brazil); and Shaw, Cayley and Flyndre (United Kingdom).

With this figure, Repsol exceeded the objective of 680,000 barrels of oil equivalent per day it had set for 2017 while also renewing its reserves, with an organic replacement rate of 93%.

During the year, Repsol reached milestones in various projects that provide value to its asset portfolio, including the production start-up of six projects. In August, gas production began at Juniper (Trinidad and Tobago) and in October, crude oil production began in Malaysia at the Kinabalu oil field redevelopment project. In November, production began at Sagari (Peru), where the equivalent of one-fourth of the gas produced in Peru is extracted.

In December, Repsol and its partners began production at the Reggane Nord gas project in Algeria. It is expected to reach its maximum capacity in the first quarter of 2018: eight million cubic meters of gas per day, equivalent to 10% of Spain’s gas demand.

During the year, the company also obtained rights to blocks in countries including Brazil, the United States, Bolivia and Mexico, and began the development of Buckskin, a large-scale project located in deep waters off the US Gulf Coast. The company has also taken investment decisions for CRD Red Emperor (Vietnam), YME (Norway), Angelin (Trinidad & Tobago) and MLN (Algeria).

In terms of exploratory activity, 2017 was a year of great success for Repsol. The company added two major discoveries in the United States and Trinidad and Tobago to its extensive portfolio.

With the former, Repsol announced the largest hydrocarbon find of the last 30 years on US soil. The contingent recoverable resources of the area where the discovery was made are estimated at approximately 1.2 billion barrels of light crude oil.

The company discovered its largest volume of gas of the last five years in Trinidad and Tobago. It is estimated that the resources found are equivalent to two years of gas consumption in Spain.

The excellent performance in the Upstream area was recognized by Standard & Poor’s Global Platts, which named Repsol the best company in exploration and production in 2017 for its ability to generate value in a context defined by volatility and low crude oil prices.

The Downstream business achieved net adjusted income of 1.877 billion euros, in line with the 1.883 billion recorded in 2016, maintaining its role as a major generator of cash for the company.

The performance of the refining area was more positive than that of the preceding year. The company increased the volume of crude oil it processed and capitalized on an improved margin indicator in Spain to 6.8 dollars per barrel, a 7.9% increase from the 6.3 dollars per barrel obtained in 2016.

Over the course of the year, Repsol carried out maintenance shutdowns at the Cartagena, Bilbao and A Coruña facilities, and introduced improvements in innovation, efficiency and productivity, allowing the company to remain at the forefront of the sector in Europe.

The Marketing area improved its results and increased sales. The company’s service stations increased volumes sold, while continuing to innovate with new services designed to expand the offerings to customers. To this end, Repsol reached agreements with top companies like Amazon, which allows customers to pick up their purchases at service stations, and El Corte Inglés, with which it has expanded an agreement to implement Supercor Stop&Go stores at Repsol Group stations.

The company also launched the Waylet application, which lets customers pay at service stations while obtaining discounts and promotions. The company will continue developing the application to evolve it into a universal mobile payment app.

In partnership with Kia, the company has recently announced the launch of a new car sharing service called Wible. As a leading energy supplier for mobility, Repsol always seeks to promote innovative initiatives that present alternative energy supply methods for transport and provide value for customers.

The contribution from the Trading and Gas & Power areas also increased, supported by more positive performance in North America and in trading activity, and aided by higher demand and better margins.

The Lubricants area increased sales while continuing its internationalization strategy, which has led to its presence in more than 85 countries. With its strategic plan, the business aims to double its total sales volume to 300,000 tons, and quadruple sales abroad. In response to part of this growth, Repsol is carrying out an investment of five million euros in its Puertollano plant, which is responsible for almost 80% of the company’s total lubricant production.

In 2017, the Chemicals business maintained the good results it obtained in 2015 and 2016, consolidating efficiency improvements and advances in differentiation.