Repsol posts net income of 610 million euros

- Repsol posted net income of 610 million euros in the first quarter of 2018. Adjusted net profit, which specifically measures the performance of the company’s business units, increased to 616 million euros.

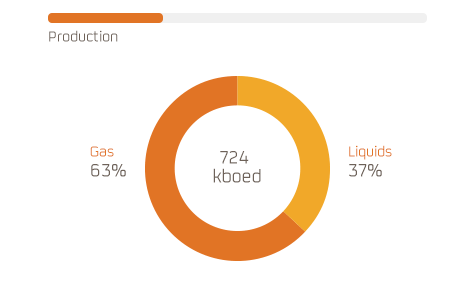

- The company increased its hydrocarbon production, reaching 727,000 barrels of oil equivalent per day, the highest since 2012.

- Earnings from the Upstream unit (Exploration and Production) increased by 43% due to higher production volumes and efficiency measures implemented in recent years, which have contributed to improve the company’s realization prices.

- The Downstream unit (Refining, Chemicals, Marketing, Lubricants, Trading, LPG and Gas & Power) continued to demonstrate a strong performance, with earnings of 425 million euros supported by significant improvement in the Marketing, LPG, Trading and Gas & Power units.

- The Board of Directors convened the Annual General Meeting, where and proposed an increase in shareholder distribution for the year to an equivalent of 0.90 euros per share.

- In addition, the Annual General Meeting will vote on a reduction in share capital through the cancellation of the company’s own shares by an amount equivalent to the shares to be issued in 2018 through scrip dividends.

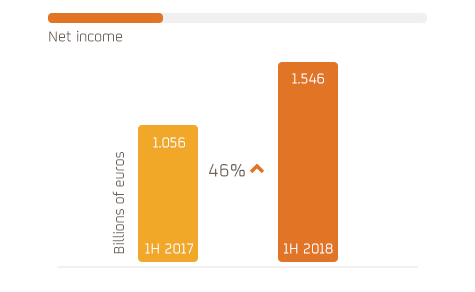

Repsol posted a net income of 610 million euros in the first quarter of 2018, compared 689 million euros earned in the first quarter of 2017, when the company booked an extraordinary effect on the value of oil product inventories held as part of Spain’s strategic reserve due to the appreciation in the price of oil.

Adjusted net income, which specifically measures the performance of the company’s business units excluding inventory effects, reached 616 million euros, compared with the 570 million euros earned between January and March 2017, which represents an increase of an 8%.

The company relied on the flexibility afforded by its integrated business model and on the efficiency and value creation measures implemented to successfully navigate the period which, compared with the same period last year, was marked by higher crude oil prices (Brent +24%), lower gas prices (Henry Hub -9.4%), and a weak dollar against the euro (-15%) and an international environment that was generally less favorable to industrial businesses.

Performance of the Upstream unit was outstanding, with an income of 320 million euros, 43% greater than that obtained between January and March of last year. The measures taken as part of the synergies and efficiencies program, the greater production volume and the increase in realization prices of crude oil and gas led to improved performance.

Downstream earnings were 425 million euros, during a quarter in which the Marketing, LPG, Trading and Gas & Power units improved their performance. As for the Refining and Chemicals units, they were affected by planned maintenance shutdowns scheduled in three of the company’s industrial facilities.

EBITDA reached 1.804 billion euros, in line with the 1.844 billion euros earned between January and March 2017.

After the end of the quarter, Repsol’s Board of Directors agreed to call the Ordinary Annual General Meeting, which will take place May 11th. The Board agreed to propose a gross shareholder distribution equivalent to 0.50 euros per share, through the “Repsol Flexible Dividend” program and as a substitute for the final dividend of the 2017 fiscal year. This distribution is in addition to that approved by the company as part of the same program and as a substitute for the final dividend of 2017, for an equivalent gross amount of 0.40 euros per share. The total shareholder remuneration will increase to an equivalent of 0.90 euros per share.

In addition, at the Annual General Meeting the Board will propose a reduction in share capital, through the cancellation of treasury stock by an amount equivalent to the shares issued in 2018 through the scrip dividends.

Furthermore, on February 22nd, 2018, Repsol reached an agreement with Rioja Bidco Shareholdings, S.L.U., a company controlled by CVC-advised funds, for the sale of its 20.072% share in Gas Natural, for a total of 3,816,314,502 euros: equivalent to 19 euros per share.

The adjusted net income of the Upstream unit increased by 43% to 320 million euros, compared with 224 million earned in the same period in the 2017 fiscal year.

The company’s management and the implementation of its efficiencies and synergies program have made this increase in earnings possible, for which the increase in production and improved realization prices of crude oil and gas were crucial.

International raw materials benchmark prices saw fluctuation during the period. The Brent crude oil benchmark increased by 24% in relation to the same period in 2017, with an average price of 66.8 dollars per barrel. In contrast, the Henry Hub gas benchmark declined 9.4% compared to the first quarter last year, to an average price of 3 dollars per million Btu.

During this period, Repsol’s hydrocarbon production reached 727 thousand barrels of oil equivalent per day, a record since 2012 thanks to increased activity in Libya, the startup of Juniper (Trinidad and Tobago), Shaw and Cayley (United Kingdom), Reggane (Algeria) and Kinabalu (Malaysia), and the acquisition of the Visund field (Norway).

During the period, the company announced a new hydrocarbon discovery in Colombia in the CPO-9 block, which is part of the major development project of Akacias, whose first phase was approved in 2018.

In Norway, the company signed an agreement in early February to acquire 7.7% of the Visund field, located in the North Sea. With this deal Repsol increases its production in the country by 50% to 30,000 barrels of oil equivalent per day.

In the month of March, the company was awarded two new exploration blocks in Mexico to reach a total of six licenses obtained since the liberalization of the sector last year. In Brazil, Repsol won three awards in the BR-15 round.

The Downstream unit increased its adjusted net income to 425 million euros, compared with the 500 million euros it recorded between January and March 2017.

Industrial businesses, Refining and Chemicals, which were influenced by a less favorable environment, and for the performed planned maintenance shutdowns in the industrial facilities of Puertollano, Tarragona and Sines (Portugal) during this period. These halts have allowed the company to implement improvements in innovation, efficiency and productivity at its facilities, enabling Repsol to remain at the forefront of the sector in Europe.

The refining margin indicator during the quarter was 6.6 dollars per barrel, higher than expected, which also increased distillation in its facilities thanks to the improvement of operations in the plants.

The Trading and Gas & Power unit increased its earnings with higher margins, favored by the low temperatures recorded during the month of January in the northeast of the United States. Similarly, the LPG business improved its performance and increased its sales, with improved margins of regulated and unregulated bottled gas, and benefited by increased demand due to the decrease in temperatures.

For its part, the Marketing area increased its earnings and sales, while it continued to innovate to provide more value to customers. The commercial alliance with El Corte Inglés has been strengthened by integrating its credit card in Repsol’s payment app, Waylet, for paying at service stations. In this way, the 600,000 clients who use the El Corte Inglés card each year will benefit from the advantages of the payment app in the Repsol stations network.

Furthermore, as part of its growth strategy for digital business, Repsol earlier this year acquired 70% of the Klikin digital platform, which will evolve its Waylet app into a universal means of mobile payment that can be used in additional points of sale beyond service stations.

In the month of January, the company also announced the launch of its new car-sharing service, Wible, in association with Kia. It will begin operating in Madrid in the second half of the year.

In the month of March and as part of its international expansion strategy, Repsol opened its first service stations in Mexico, the startup of a long-term project to achieve an 8-10% market share in the country in the next five years.